Why should you digitize your business receipts?

Digitizing your receipts using a receipt capture app is the first step in managing your business receipts and automating your bookkeeping. These amazing apps will at a minimum help you easily find your paperwork, but can also be leveraged to automatically extract the data from your receipts and automatically enter them into your bookkeeping app like Xero or Quickbooks Online.

But like any business tool, apps that digitize your receipts are only useful if you use them.

What does your receipt management system look like?

Are you crumpling them in pockets? Shoving them in your wallet? Do you have a folder in the truck? How many times do you touch a receipt from the start of your process to the finish?

Whatever your current system, you’re going to want to make some changes moving forward, unless of course you’d rather spend more time on paperwork and less on making your business successful!

Your goal should be to work in real time. Having up-to-date bookkeeping information is how you build a long-lasting, profitable business. If you want to dive deeper into why this is important, check out our article XXX.

The quicker you digitize your business receipts, the more up to date your bookkeeping will be. Your goal should be to digitize a receipt as soon as you get it and chuck it once you do. Only. Handle. It. Once. I understand that might not be realistic, but if you set “immediately” as the goal you now have the opportunity to make changes to the way you do things and get closer to that goal.

With a little time, you will soon find that the little dopamine rush you get from snapping your pic and tossing that little menacing piece of paper in the trash before you even exit the store is literally ADDICTIVE.

What does this look like in real life?

How do you make digitizing your receipts easy?

Picture this:

You gas up your work truck, hop back in the cab, open your receipt capture app, snap the picture and toss the receipt. It takes seconds to do it. You know it’s handled and you don’t have to keep track of that piece of paper anymore. You don’t have to think about it any more and that frees up mental energy that you can spend on things that are important

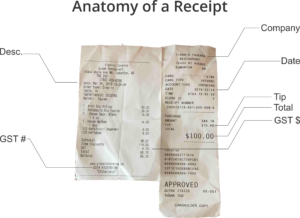

And behind the scenes, the OCR technology these apps run on is extracting details like supplier, amount, date and tax – in Dext’s case, all without your input.

Avoid mistakes when using Dext by following these guidelines for taking photos

But the OCR technology in Dext, Hubdoc or Quickbooks Receipts won’t work if you’re taking bad photos so no matter which app you choose, you need to follow a few photo taking tips to get the best results.

Photo Tips:

![]()

1 Good Lighting

- Use natural light. Overhead lights can cause shadows and blurriness

- Avoid using your flash

2 Flat Receipts

- The more crumpled or creased a receipt is, the harder it is to get a clear picture and the longer it takes to photograph it. Keep them in good shape to begin with.

- Flatten them as much as possible by hand. If they won’t lay flat use a report cover or sheet protector (matte not shiny) to flatten it, or simply hold it flat with one hand while you take the pic with the other.

3 Take Pictures of the Right Things

- Separate till and credit card receipts and photograph them side by side. Make sure nothing is overlapped

- Remember that a credit card slip is not a valid source document so you must have the till receipt

- Make sure you understand what CRA requires. This is creditical or you will waste your time taking pictures of the wrong things.

- Get an accountant or bookkeeper to look at your photos before you start thowing them away. While you are learning, you can keep a box or envelop to drop them in “just in case”.

4Multi-page Documents

Dext has a “combine” option on their app that makes it really easy to digitize multi-page documents like a hotel bill or vehicle repair bill.

Your photo’d receipts will be archived and organized in Dext automatically. If you ever need to find a document again, you can find what you need in seconds. No more shuffling through paper piles!

Want to see a demo of Dext photo snapping in action?

4 BIG Reasons Dext is Great for Small Business Owners

- It handles multiple payment accounts. If you have more than one credit card, Dext is the only app that can automatically detect the payment account.

- Dext can take photos of multiple page documents. Surprisingly, neither QuickBooks or Hubdoc can do this.

- OCR is incredibly accurate. Dext’s OCR capability is far superior.

- It’s reliable. Hubdoc prone to being glitchy!

Hubdoc outshines in its amount searching capability. You can search for an amount and it will handily find it on statements and receipts! I also give Hubdoc an edge for its ability to fetch utility bills and bank statements (Dext is weak in this area).

It’s hard to change and harder to establish new habits. Seldom does something come along that can win you back so much of your time for such a tiny investment. If you did just one thing to make your business better this month, consider using a receipt capture app.