A Complete Guide for Canadian Business Owners

The 5 Steps to Setting Up Your Business Bookkeeping

- Catch Up – Get control of your receipts and invoices

- Keep Up – OHIO (Only handle it once) Get organized once and for all

- Go Paperless – Never lose a deduction

- Take it to the cloud – Cloud bookkeeping apps are the way to go

- Run your numbers – Make your business productive and profitable

Is the way you’re managing your business bookkeeping & finances right now working for you? Do you feel like you have all the information you need to build a profitable business? Or are you setting it all aside for another day?

James Clear, the author of Atomic Habits, said it perfectly:

You do not rise to the level of your goals. You fall to the level of your systems.”

But how? How do you transform your bookkeeping into a well-oiled automated machine instead of always feeling like you’re working hard and getting nowhere.

Here we will lay out a financial plan of attack for you. A way to declutter your mind so you can focus on more important things. Think of it as KonMari for bookkeeping.

A way to set up your bookkeeping so you can get a handle on your paperwork and finances without wasting time on stupid stuff.

We’ll show you how to automate your bookkeeping so you’ll have all the data you need to make your most important business decisions.

My goal is no longer to get more done. but rather to have less to do

Francine Jay

None of this information is new. But it’s hard to Google your way to success when it comes to setting up a bookkeeping system for your business.

Seriously, none of this is a secret.

We’re going to give you everything you need to know to set up a good bookkeeping and financial management system right here. Dismiss feelings of overwhelm. You can do it by following 5 simple steps to mastering your business bookkeeping.

STEP ONE – (Don’t) Catch Up on Your Bookkeeping

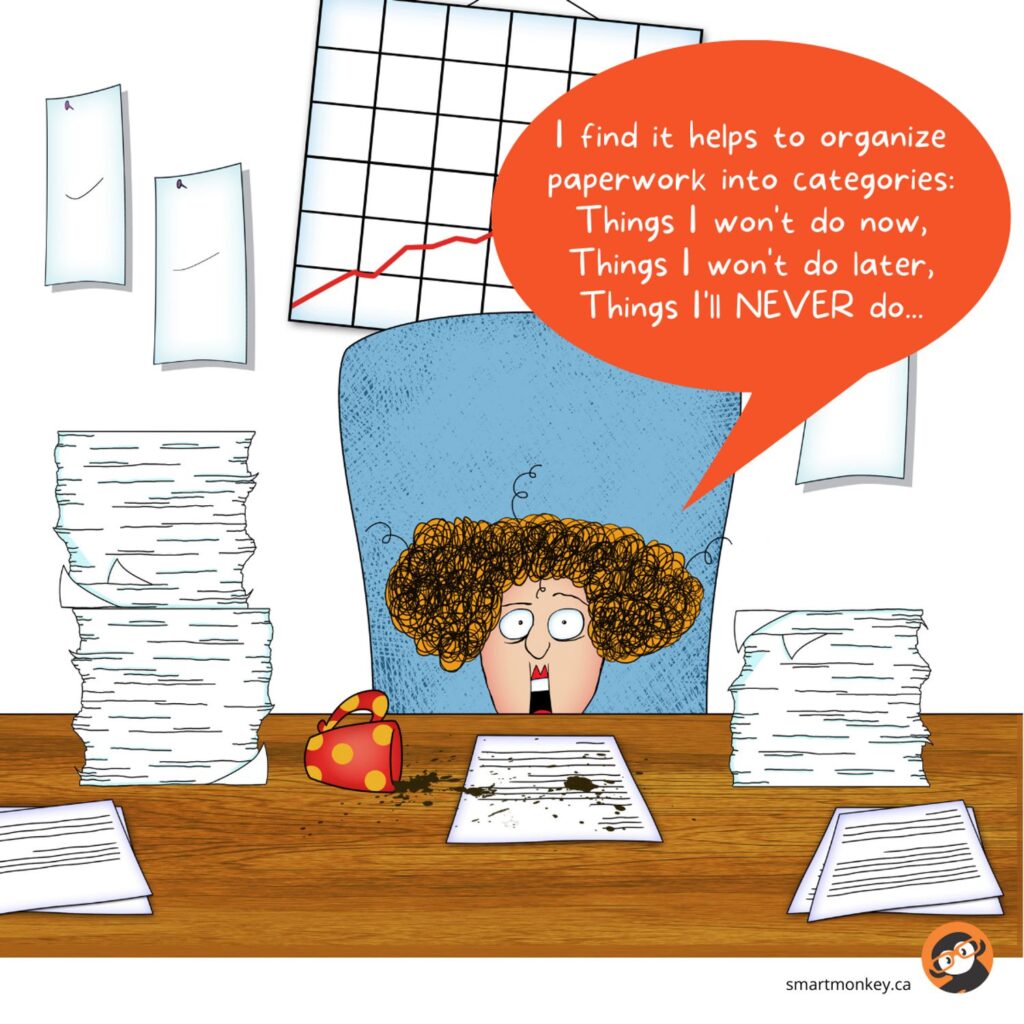

You know it’s there. The little paper piles, unopened mail, and shoeboxes full of receipts. The disorganized receipts, and unpaid bills making up your ugly backlog of unfinished bookkeeping.

A lot of small business owners think they have to go to ground zero and fix every wrong thing they’ve done in the past before setting up their business bookkeeping. Or worse…

They reinvent the wheel and make up their own way.

Don’t do it! It’s a trap!

There are a couple of reasons you should NOT do that, at least not yet.

First, and most importantly, while you are spending time wading through the quagmire and not getting around to it, you are getting further and further behind.

STOP IT!

Secondly, you don’t know what you don’t know… at least not yet. Do your efforts amount to trivial busywork? You are about to discover new ways of handling your bookkeeping. Ways that WILL help you get the old monkeys off your back much FASTER. Starting from ground zero is a MISTAKE… trust us!

ACTION Don’t do A THING… at least not yet!

“If you always do what you always did, you will always get what you always got.”

Albert Einstein

STEP ONE – (Don’t) Catch Up on Your Bookkeeping

The Secret Sauce – Get Organized Once And For All

All of the piled up things in your life are the result of a deferred decision. You either didn’t know what to do with it, didn’t know what it was, didn’t have a place for it, didn’t want to deal with it… there are a million reasons why.

All of the piled up things in your life are the result of a deferred decision. You either didn’t know what to do with it, didn’t know what it was, didn’t have a place for it, didn’t want to deal with it… there are a million reasons why.

You must resolve to Only Handle It Once. The most important step of all. Get this right and everything will start falling into place.

O-HI-O

So simple.

Think of it this way: if you leave it, you will spend 2.5x longer doing it later because

ONE: You forget things; i.e., what was it for? What job? What even is it? or

TWO: It dries on.

Every time you choose to defer handling a receipt, you are making an agreement with yourself to spend 2.5x longer dealing with it in the future.

Defer a 10-minute job now, it will take you 25 minutes later.

If you do that enough, pretty soon you’ll come to the realization that EVERYTHING you do is taking 2.5x longer.

You end up caught in a vicious cycle of always working on backlog and never catching up.

Your business bookkeeping ends up shoved in the box, waiting in the corner to pounce on you at tax time.

No wonder it can get overwhelming!

We’d like you to commit to doing something from now on: When you get a new email in your inbox, or remember an appointment you need to schedule, and it would take you 2 minutes or less to handle it, DO IT! Get it done, and get it off your mind.

This will help you start to free up that big beautiful brain of yours for the more time-consuming tasks.

When it comes to piles of receipts and financial papers, from this day forward you are going to ONLY HANDLE IT ONCE. That’s job one.

ACTION Start reciting your new mantra: ONLY HANDLE IT ONCE

The Band-Aid solution is actually the best kind of solution because it involves solving a problem with the minimum amount of effort and time and cost.

Malcolm Gladwell

STEP THREE – Go Paperless

Never Waste Your Time or Lose a Business Deduction (Again)

It’s hard to change and harder to establish new habits. But if you did just one thing, consider a receipt capture app. Seldom does an app come along that can win you back so much or your time for such a tiny investment.

Using your new O-HI-O mantra, when the paper lands, no matter what it is, you are going to use your handy new app to shoot it (photo that is) and bag it!

Consider this: Say you have a receipt for a printer you purchased for $500. You buy the printer and stuff the receipt in your pocket where it is quickly forgotten. Later on, you try to find it, but are soon distracted. The next time you see it, it’s had a trip through the washing machine. Poof. Gone forever. And so is the business deduction.

If you can’t deduct the expense, think about how many sales have to be brought in to offset the loss. If my profit margin is around 20%, I have to bring in $2500 in sales just to break even.

While there are quite a few tools out there that will help you digitize your documents, we only recommend three. Check out our article for the rundown of the top 3 receipt capture apps.

If you’re not sure if you need a piece of paper, take a photo anyway. You can’t make a mistake! You can visit our article on what business paperwork to keep to become a BOSS at knowing how and what to capture.

There are a couple of things to keep in mind:

What do I do with the receipts?

Technically, you don’t have to keep it BUT when you are a newbie at being paper free, we recommend keeping the paperwork you’ve digitized in a box. There are CRA rules about digital record keeping and until you get to know them, a box is a great back-up plan.

Don’t worry about organizing your box. Your app will do the organizing for you; the box is just in case. You must remember to O-HI-O.

How do I keep track?

Don’t photograph the same thing twice. This is easily accomplished by making some sort of mark to indicate you’ve done it.

Examples: Chew a corner off, make an origami swan or fold it lengthwise. Something that tells you that it’s done and that you can do in the moment. Pick something that’s not dependent on having a pen nearby.

When do I take the photos?

Speaking of in the moment, TAKE YOUR PHOTOS RIGHT AWAY!

If you don’t, it will take you 2.5x longer later and you won’t be able to see your real-time financial information… but we’ll get to that later.

ACTION Download a receipt management app right now, and take your first photo.

“The paperless office is possible, but not by imitating paper. Note that the horseless carriage did not work by imitating horses.”

Ted Nelson

STEP FOUR – Take it to the Cloud

This is where you wave good-bye to your spreadsheet or your desktop accounting software. It served you well in the beginning, but in order to “level up” and create a great bookkeeping system for your business, you’re going to need to trade in your preconceived ideas about bookkeeping and get yourself the right tools and training. There is no better investment than a great, cloud-based accounting system!

What makes a bookkeeping system great?

When you take a look at any profitable business, you will find that the owners are in tune with the financial end of things; you don’t see them throwing up their hands and leaving that vital area up to someone else or shoving it in a box to worry about at the end of the year.

Knowing what’s profitable, managing your cash flow, and planning for your future can only be done with financials at your fingertips. How are you going to know what direction to take your business in if you don’t know your numbers inside and out?

7 ways a great bookkeeping system helps you

- Greatly reduces manual data entry

- Eliminates your paper

- Shows you what you owe and who owes you at a glance

- Shows you how profitable you are in real time

- Eliminates collections issues with customers

- Provides access for you and your team members wherever they are

- Saves you buckets of time

- Automates 99% of bank and credit card reconciliation

Understanding your finances will take you so much farther than a hope and a prayer.

The Elephant in the Room

Before we get started on the steps for setting up your business’ bookkeeping system in the cloud, let’s talk about the elephant in the room.

Before we get started on the steps for setting up your business’ bookkeeping system in the cloud, let’s talk about the elephant in the room.

You’re an entrepreneur! You’ll tackle anything… we get that!

BUT, you didn’t decide to be your own boss to spend time reinventing the wheel.

One of the best qualities of an entrepreneur is the figure-it-out attitude. They figure out how to do it all themselves for one reason or another, be it perceived savings or just plain ingenuity.

But when it comes to setting up a way to manage your business finances, figuring it out or bootstrapping it is a mistake.

You wouldn’t give a 16-year-old who has never been behind the wheel the keys to your Ferarri and tell them “go figure it out”.

With the right tools and training, you can hit the ground running and focus your attention on bringing dollars through the door. At the same time, you’ll avoid pitfalls…

EXPENSIVE pitfalls.

Don’t reinvent the wheel

You need a bookkeeping system in the cloud. This will give you and anybody you work with (your accountant, your key employees) access no matter where you or they are, including from your phone.

Being able to provide estimates or invoices and accept payments on the spot are imperative to long-term success and maximizing efficiency. That efficiency equates directly to sales!

Look for a full feature bookkeeping program; your primary choices in this field are QBO and Xero. Avoid programs like Freshbooks, Wave, Kashoo, and Quickbooks Self-Employed. They have limited features and more importantly, limited integrations to other programs.

You want your systems to be able to grow with you, and talk to each other. No matter what system you choose, you’ll have to set up your software the same way.

Follow these steps to set up your bookkeeping software:

- Input your company info

- Go through all of the company settings

- Set up your COA – Import a simple chart of accounts; you can even use the categories you are using in your spreadsheet as a start.

- Set up product & service items

- Integrate your receipt app

- Connect your bank feed

- Import any missing bank data

- Set up rules

- For corporations, bring in your opening balances

- Set up users, invite your accountant

As you start to use your bookkeeping program daily in your business, always be tweaking and build checklists for daily, monthly, quarterly and yearly tasks as you go.

Overwhelmed?

We know it sounds like a lot, and there will be a learning curve to whichever software you choose.

It’s just a matter of approaching things step by step.

The last thing you want to do is invest a bunch of time and money into a system that doesn’t serve you, so it makes sense not to “wing it.” You aren’t likely going to be successful getting through grade two without finishing grade one.

ACTION Setup your bookkeeping software and integrate with your receipt app.

STEP FIVE – Know how to keep the pulse of your business

Taking a box full of paper to the accountant once a year seems like an easier option than doing all of this right? The trouble is, it misses the point. It shouldn’t be just about filing your tax return.

If you leave it all up to someone else, it might seem easier, but it leaves the door wide open to all kinds of problems in the long run.

3 questions you must ask before you hire a bookkeeper

- Do you understand how accounting data helps you operate your business?

- Do you have enough accounting knowledge to know if they are doing it right?

- Do you know how to recognize the signs of fraud in your small business?

Getting your business taxes filed may keep the tax man off your back, but it does very little for your business otherwise.

Do the year-end financials your accountant gives you tell you how your cash flow is doing month to month?

Or how long it takes to collect on your invoices?

How about which products and services are the most profitable, and which ones are costing you money?

What about your customers? How much is your best customer worth and how long do they take to pay you? Understanding your data will allow you to focus your business on the activities that will drive it towards your goals.

This is why once you’ve got your data coming in real time to your bookkeeping software, you need to analyze it.

Start using products and services and the project modules in your bookkeeping software to do some testing on your business’ current products or services.

Project tracking will allow you to look at all of the costs and revenue associated with a job, so make sure to include labor, overhead and any consumables. We recommend doing this for at least three projects of each type to get a good data sample set.

So for a company that does both commercial and residential window washing, they would want to track at least three commercial projects and three residential ones.

Once you’ve collected your information you can then start to analyze the numbers and see:

- Is your labour/time investment what you budgeted for?

- Were other expenses in line with what you expected?

- Was your profit where you thought it should be?

- Do you see a pattern in any unexpected costs?

- How easy was it to collect on these projects?

- Do they seem to be worth the money you’re making?

- Did you enjoy running these projects?

- Did you like the customers you worked with?

Do the last two questions seem strange to you?

Yes profit matters, but how much time are you spending on jobs and with people that you just don’t like?

At some point you’re going to have to shift your business towards sustainability which is pretty tough to do if you’re not making money or doing work you don’t enjoy.

Your Business’ Billing & Collections Practices

We encourage you to take a hard look at the way you’re running your quoting, billing & collections.

Too often we see entrepreneurs spending months chasing down payments from customers or having to discount their bills in order to collect.

You don’t need to fix your collections; instead fix the way your price your job and communicate with your clients. Use online quoting and digital signatures to set the price up front, and digitally record your customers agreement of the price.

But wait, you bill hourly? Why?

How does an hourly rate serve you? Does it make it easier for your customers to accept their bill?

In most cases it’s harder for your customer to swallow. If you have any experience in your industry you should be able to create fixed prices for most of your work and be upfront with your customers. If you can’t price a job up front in full, that break down the project into phases that you can price.

Your 4-step collections action plan:

- Use a software to create a standard quote that’s easy to replicate, email, and collect a digital signature on.

- For projects that require several days or weeks of work, collect a retainer up front.

- Implement progress billing – at least monthly for larger projects (make progress billing part of your quote and standard contract).

- You are not a bank or a credit card company – collect onsite or upon delivery. Don’t leave a job or let a client leave your office without processing their credit card or setting up an automatic bank withdrawal.

If a client already owes you money – DO NOT do more work until you get paid.

Remember that being clear with your customers about how you conduct your business is the best defense against bad debts. You teach people how to treat you properly by not giving away your services.

“Sometimes it gets harder before it gets easier”

“Asking lots of questions leads to better outcomes”

ACTION Run reports, learn what they are telling you, find ways to improve your profitability

Putting it All Together

I know the idea of setting up a new system can be overwhelming. But I have every confidence that with a little time, and a little patience, you can do it.

All you have to do is start.

Start looking at habits that aren’t working for you.

Start being more efficient with your time.

Start using a receipt-capture app.

Start taking photos.

Start creating a system that works for you.

And if you still feel overwhelmed. If you still feel like you can’t do it. If you still feel lost.

Then reach out to us. We can help you.

Smart Monkey has created The Bookkeeping Antidote Membership for business owners just like you. Get the apps, training & support you need to master your business bookkeeping.